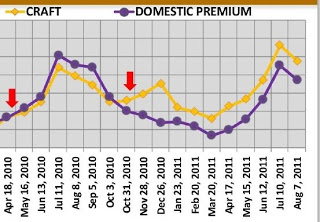

Sales of Craft Exceed Domestic Premium in the Pac NW

Last week, I began what will be a short series of posts on a presentation Dan Wandel made for SymphonyIRI that looked at sales figures and trends for craft beer sold at supermarkets (post 1, post 2). Today I'm going to highlight the last slide Dan showed us. It's a graph of two segments of the beer market, domestic premium and craft beer. It was a complex chart going back 2 1/2 years and split between Oregon and Washington. I've reproduced a detail of the slide showing the past year's sales in Oregon. Washington's looks roughly the same.

In April 2010, craft beer briefly outsold domestic premiums, then fell behind again. But in October, craft passed domestic premium again and hasn't looked back. It's worth adding a bit more context to fully understand these numbers. Keep in mind that Symphony/IRI only tracks supermarkets, not specialty retailers like Whole Foods and New Seasons--where craft beer massively outsells domestic premium. It also doesn't capture draft sales. In other words, the company tracks sales in the place most favorable to the domestic premiums like Bud and Coors.

The other thing to acknowledge is that the NW is way out in front of everyone. The point in preparing the slides is to illustrate craft beer's potential nationally based on their actual numbers here. We tend to think that craft beer will never supplant national light lagers, but these figures show they can.

One final point. In his presentation, Wandel sometimes included A-B's Shock Top and Coors' Blue Moon in the craft segment and sometimes he didn't. But no matter what segment you put them in, it's worth noting that they sell more than any single craft brand. (At the blogger's conference, I asked Blue Moon's Lisa Zimmer how many barrels that brand sold, and I think she said 1.7 million. That's about 10% the size of the entire craft market.)

Some people get freaked by the idea that the macros are co-opting craft beer, and to a certain extent, so am I. The silver lining, though, is that craft is now the tail that's wagging the dog. Macros see charts like the one in this post, and they see the writing on the wall: Americans are increasingly rejecting light lagers. People have been looking at SymphonyIRI's numbers on macros and seeing staggering five-year declines in domestic sales: Budweiser -30%, Miller Genuine Draft -51%, Old Milwaukee -52%, Michelob -72%. The trends are unmistakable: light lagers, though still the dominant player in beer, will continue an inexorable decline in the years ahead, replaced by more flavorful ales. Just look at what's happening in the Northwest.

_________________

CHART: SYMPHONY/IRI

In April 2010, craft beer briefly outsold domestic premiums, then fell behind again. But in October, craft passed domestic premium again and hasn't looked back. It's worth adding a bit more context to fully understand these numbers. Keep in mind that Symphony/IRI only tracks supermarkets, not specialty retailers like Whole Foods and New Seasons--where craft beer massively outsells domestic premium. It also doesn't capture draft sales. In other words, the company tracks sales in the place most favorable to the domestic premiums like Bud and Coors.

The other thing to acknowledge is that the NW is way out in front of everyone. The point in preparing the slides is to illustrate craft beer's potential nationally based on their actual numbers here. We tend to think that craft beer will never supplant national light lagers, but these figures show they can.

One final point. In his presentation, Wandel sometimes included A-B's Shock Top and Coors' Blue Moon in the craft segment and sometimes he didn't. But no matter what segment you put them in, it's worth noting that they sell more than any single craft brand. (At the blogger's conference, I asked Blue Moon's Lisa Zimmer how many barrels that brand sold, and I think she said 1.7 million. That's about 10% the size of the entire craft market.)

Some people get freaked by the idea that the macros are co-opting craft beer, and to a certain extent, so am I. The silver lining, though, is that craft is now the tail that's wagging the dog. Macros see charts like the one in this post, and they see the writing on the wall: Americans are increasingly rejecting light lagers. People have been looking at SymphonyIRI's numbers on macros and seeing staggering five-year declines in domestic sales: Budweiser -30%, Miller Genuine Draft -51%, Old Milwaukee -52%, Michelob -72%. The trends are unmistakable: light lagers, though still the dominant player in beer, will continue an inexorable decline in the years ahead, replaced by more flavorful ales. Just look at what's happening in the Northwest.

_________________

CHART: SYMPHONY/IRI